green card exit tax irs

In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue Code Section 877A which applies to certain US. Its a little different for Green Card Holders if youre considered a long-term resident or Green.

What Is Form 8854 The Initial And Annual Expatriation Statement

The basic rate of UK income tax is.

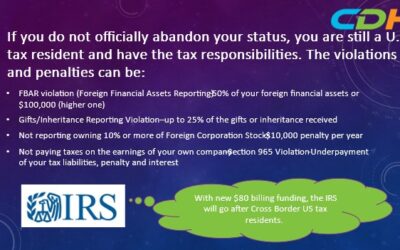

. Exit tax applies to United States. When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective. For many Legal Permanent Residents once they learn about the IRS tax liabilities for being a Green Card Holder along with the potential.

Exit Tax is a tax paid on a percentage of the assets that someone who is renouncing their US citizenship holds at the time that they renounce them. When a US person gives up their green card it can be a very complicated ordeal from an IRS tax perspective. Giving Up a Green Card US Exit Tax.

When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and deemed. Giving Up a Green Card US Exit Tax. Surrendering a Green Card US Tax Rules for LTRs.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. Giving Up a Green Card. For Green Card holders to be subject to the exit tax they must have been a lawful permanent resident of the Unites States in at least 8 taxable years during a period of 15 taxable.

The personal allowance is 12500 in the 20192020 tax year. 20 for earnings that exceed 12500 up to 50000. Green Card holders who do want to retain their Green Card though should submit USCIS Form I-131 before leaving the US.

You fail to indicate on Form 8854 that youve filed a tax return for each of the past five years. 40 for income between 50001 and. Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status.

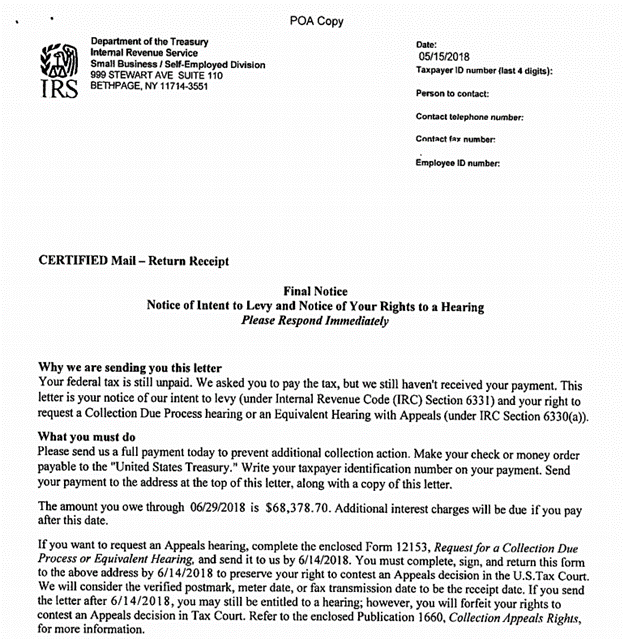

From an immigration perspective it is. Failure to file a tax return as a green card holder is punishable by fees of 5 of the total owed balance of taxes compounding up to 25 for continued failure to pay. This application for a reentry permit can be used for absences from.

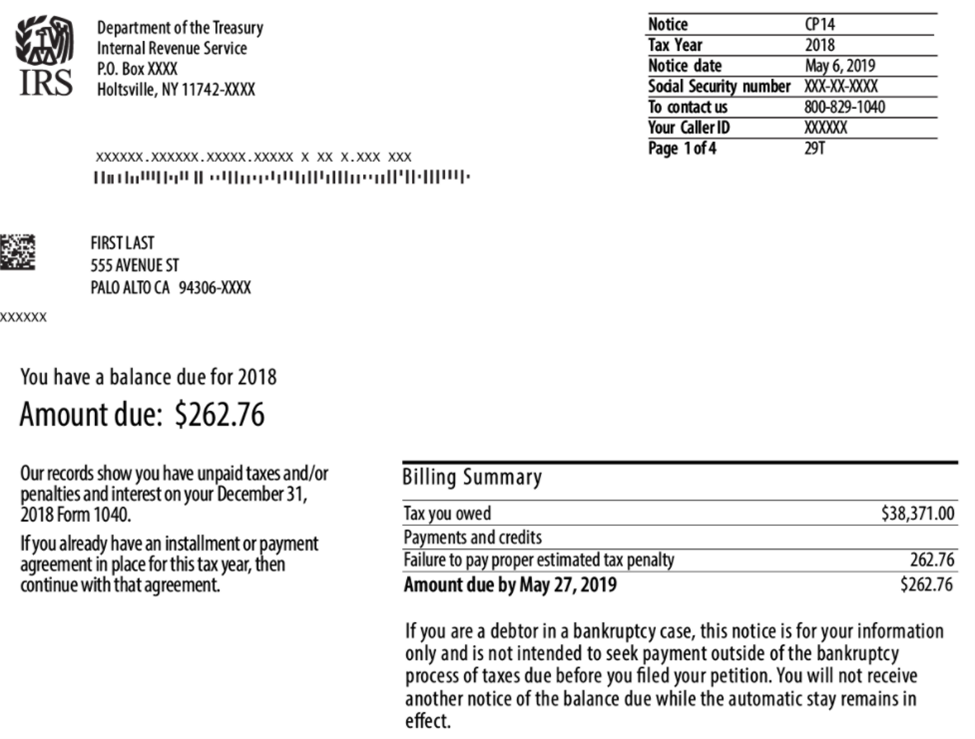

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Are You Subject To The Us Exit Tax Effisca

Green Card Holder Must File Form 8854 Before Leaving Country Youtube

Reverse Immigration How Irs Taxes Giving Up Green Cards

Exit Tax Quintessential Tax Services Us And International Tax Services And Consultation

Tax Advice For Expatriation Giving Up Your Green Card Or Your U S Citizenship Part I Los Angeles Offshore Banking Lawyer Dennis Brager

How Does Heart Act Exit Tax Affect Us Resident Australian Expats

Exit Tax For Renouncing U S Citizenship Or Green Card H R Block

Green Card Holder Must File Form 8854 Before Leaving Country Youtube

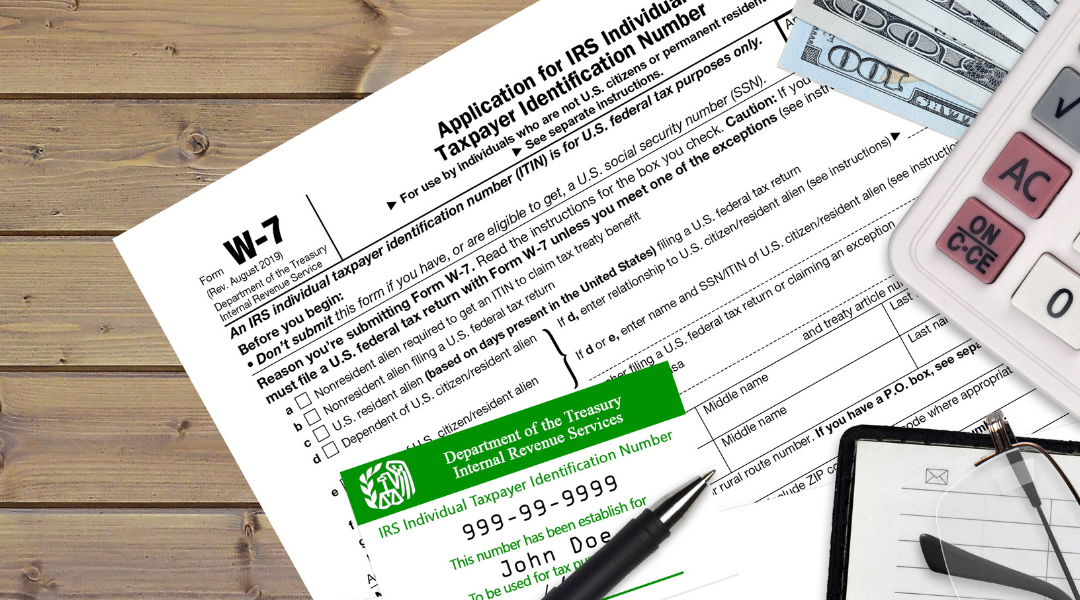

Applying For A U S Tax Identification Number Itin From Canada Us Canadian Cross Border Tax Service Cross Border Financial Professional Corporation

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

How To File Your Taxes In 2022 Before The Deadline Cnn Underscored

Common Renunciation And Irs Exit Tax Questions

The Role Of Irs Form 8854 In Renouncing Us Citizenship Expat Tax Professionals

Us Tax Green Card Holders First Time Filers Exit Tax

Understanding How To Qualify For Naturalization When You Owe Irs Taxes Cnw Network

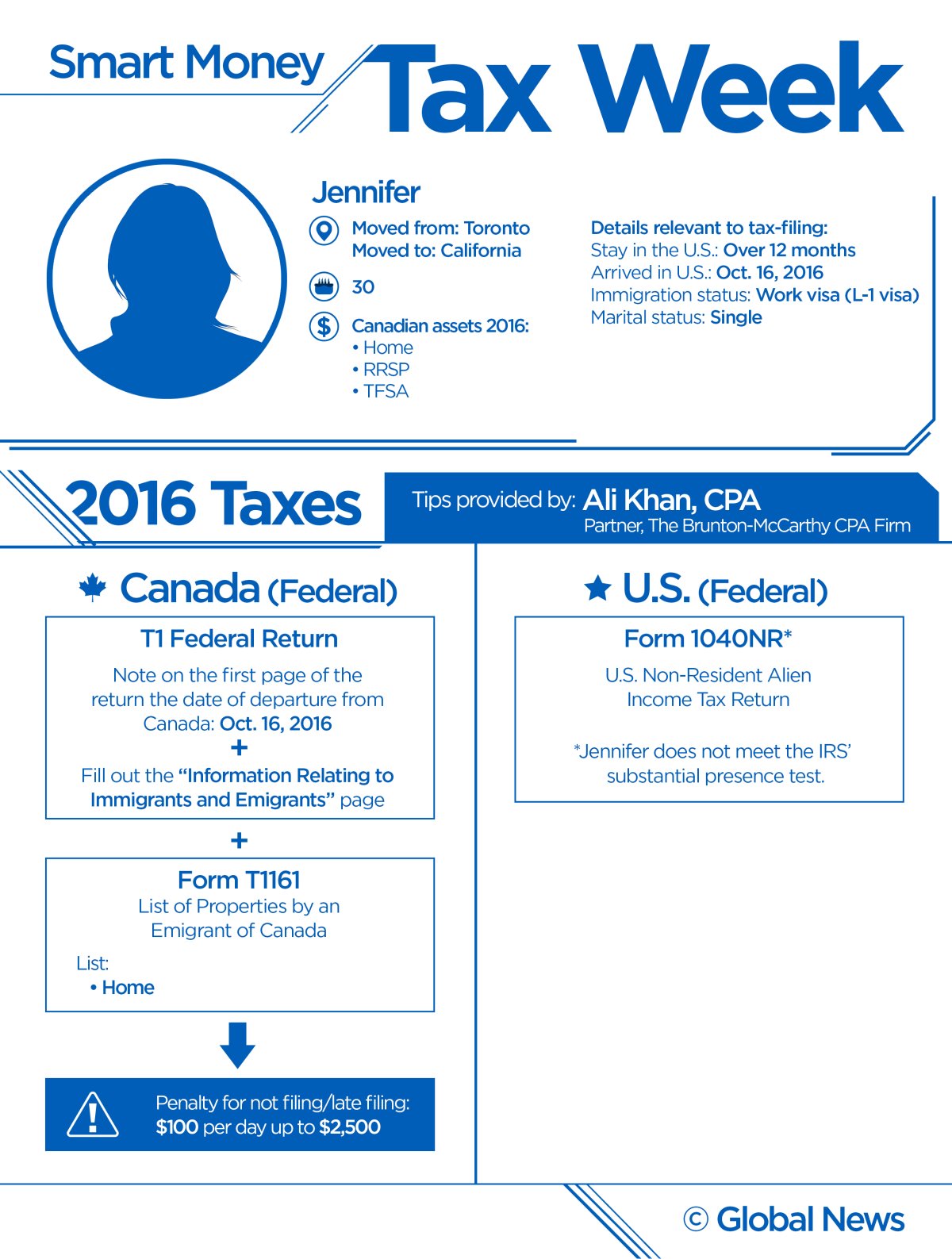

Moving Abroad Mistakes On Your Tax Return Could Wipe Out Your Savings Globalnews Ca